Two-pot

Things to keep in mind

- You can only access your money from your savings pot, once every tax year.

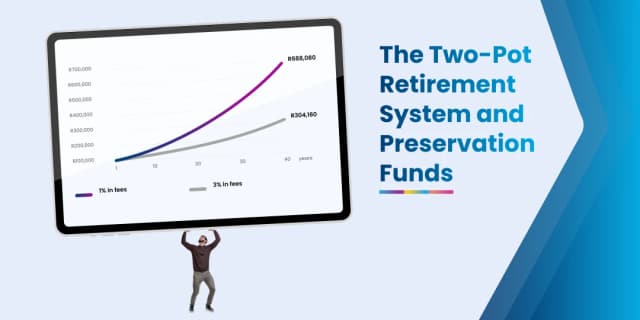

- Any amount saved in a retirement fund will be split into a savings component and a retirement component.

- One-third automatically goes into the savings component and two-thirds into the retirement component.

- The funds in the savings component should only be used in case of an emergency, such as a medical emergency or natural disaster.

- The money you withdraw from the savings pot will be added to your taxable income and taxed at your marginal tax rate – and for some high earners, you are looking at being taxed 45%.

Below you will find access to 10X brochures on the new two-pot retirement legislation coming into effect later this year. You'll also find some frequently asked questions that we hope will clarify the effect of the new system on our clients.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.