What are the tax benefits of a retirement annuity?

- Contributions are tax deductible

The higher your retirement annuity payments, the higher your tax refund could be.

- Reduce your taxable income by contributing up to 27.5% of your earnings up to R 350,000 per year

- The limit applies to all of your retirement savings combined

- Contributions exceeding these limits roll over for future deductions

- Growth on your money is tax free

Pay zero tax on investment returns. No tax on interest, dividends, or capital gains

- Access a tax-efficient lump sum at retirement

When you retire you can take up to 1/3 of your retirement annuity as a lump sum. With lower tax rates on additional withdrawals

Calculate your tax savings

When you invest in a retirement annuity, you lower your taxable income for the year, which could result in a tax refund from SARS, and a bonus for you.

Use the calculator below to see how increasing your retirement annuity contribution can lower the amount of income tax you pay.

Related articles

How to get more out of your retirement savings

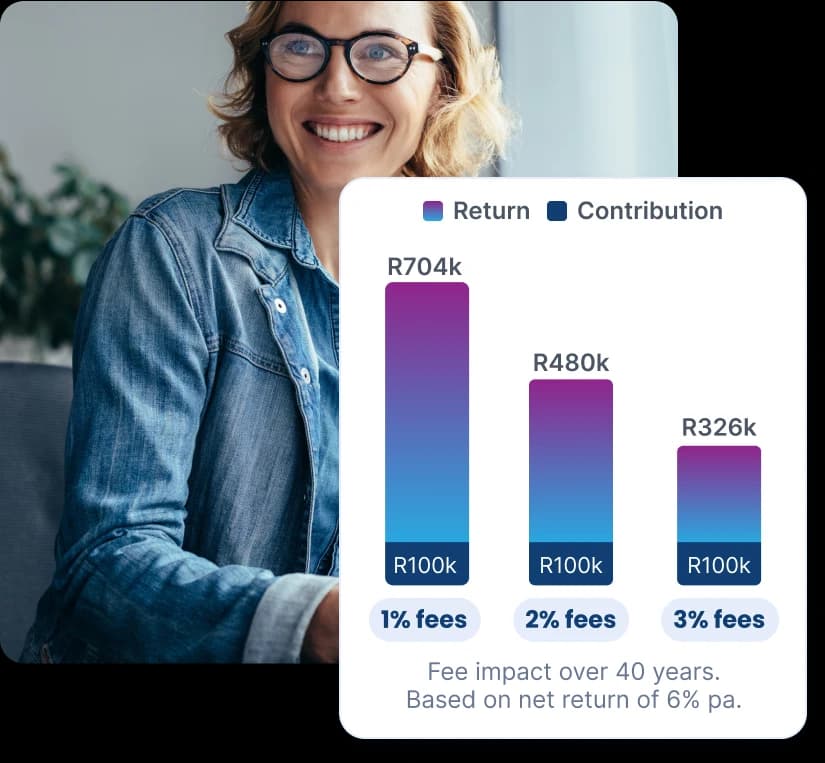

Fees can make a big difference to your retirement savings over time. At 10X, we believe in keeping things simple with a single, low fee that helps your money work harder.

Want to see the difference? Get a free, transparent comparison of your current retirement savings against what 10X offers. We'll show you exactly how our Retirement Annuities, Preservation Funds, and Living Annuities could help maximise your savings potential.

Claim your retirement annuity tax benefits

When tax season comes around you’ll need to show how much you have contributed to your retirement annuity. You can get this from your income tax certificate which is issued by your provider.

How to get your 10X tax certificate

For 10X clients you will need to log in to your My10X account and download it from the Documents section.

Speak to an investment consultant

Speak to an investment consultant

Real assistance by real people

No chatbots, call centres or weeks waiting for a response. Our team is here to help via email or phone.Easy switching

We'll fully manage the switch from your old provider.Clear product information

We'll explain our products and funds so you can make the best choice for you. No advice, just the facts.

Leading companies invest with 10X