What is a tax-free savings account?

A tax-free savings account is type of investment designed to help you save money without paying tax on the interest you earn or the dividends you receive. You can withdraw your money at any time without paying tax on the amount you take out.

A tax-free savings account (also known as a "TFSA") is a great way to save for long term goals without paying tax on interest earned or dividends received. You will have easy access to your funds and won't pay tax when you make withdrawals.

Benefits of a tax-free savings account

You don't pay tax on any interest, dividends or capital gains

You can withdraw your money at any time

You can contribute up to R36 000 per year

You can have more than one Tax-free savings account

Why open a 10X Tax-free savings account?

Low fees

Lower fees means higher returns. Retirement Annuity fees starts at only 1.04% and reduces the more you invest.

Index tracking

Trying to pick winning stocks usually fails. By tracking an index, we deliver higher returns than most fund managers.

Transparency

Track your investment performance and fees anytime through our client portal. Simple, transparent access to your savings.

Diversification

We invest your money locally and internationally in a high performing mix of shares, property, bonds and cash.

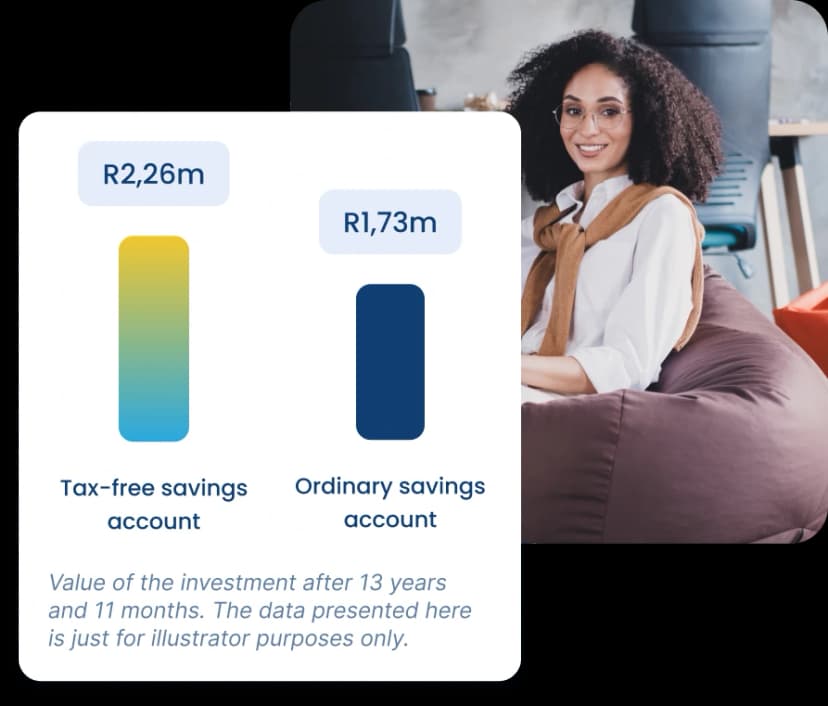

More money, more tax saved

Tax-free investing maximises your returns, especially over the long term. Your savings grow faster as you earn compound returns on money that would have gone to tax.

Here's an example of the TFSA advantage: Invest R 3,000 monthly until reaching the R500,000 lifetime limit, and with an estimated 8% annual return, your tax-free investment will be worth 30% more than a regular savings account at the 45% tax bracket.

Our fees are simple and transparent

Our fees are simple and transparent, so you know exactly what you're getting in your investment. You'll pay an annual fee between 0.33% and 0.69%, depending on which fund you choose.

No platform fees

No broker or adviser fees

No exist or penalties for changing your investment fees

Speak to an investment consultant

Speak to an investment consultant

Real assistance by real people

No chatbots, call centres or weeks waiting for a response. Our team is here to help via email or phone.Easy switching

We'll fully manage the switch from your old provider.Clear product information

We'll explain our products and funds so you can make the best choice for you. No advice, just the facts.

Choose the best 10X fund for you

We have a selection of funds available for each product. Need help choosing a fund? Use our Fund selection tool

Need help finding the right fund?

Use our fund selection tool to see what fund is best for your needs

10X Your Future with superior returns

This fund consistently outperforms other leading fund managers, so it's not surprising that most 10X investors choose this fund to help them reach their long-term goals.

Benefits of the 10X Future Fund

Local and international investment

Diversified

Low fees

Ready to start investing in a 10X tax-free savings?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.

Leading companies invest with 10X