How to turn tax season into bonus season with your retirement annuity

9 January 2025

The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]

We sit down with 10X Investment Consultant lead Andre Tuck and discuss the retirement savings crisis in South Africa. We also delve into living annuities, retirement annuities, TFSAs and everything in between. Read more

![The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F5ipSTnRq5Dp25fyghm5kGQ%2F02c801c78d5e1ca9280bfd34d7602368%2FAndre_Tuck_podcast_cover_image__1_.webp&w=828&q=75)

Taxes – something most people don’t like to think about. But thinking about your taxes (and taking action where appropriate) can potentially yield good results – namely, more money in your bank account. Now at 10X, we’re not tax specialists, and what follows shouldn’t be construed as tax advice. However, we are retirement specialists, and our hope is that presenting the facts about the overlap of retirement investments and tax will help you make better decisions and ultimately enable the retirement you deserve.

Our investment consultants have helped thousands of South Africans navigate the fine print of their finances for over a decade. They can help you understand tax efficiency in your investments – and unlike traditional financial advisors, there’s no cost associated with speaking to them.

Build the retirement of your dreams with our

Retirement Annuity calculatorSo, what do you need to think about to maximise your tax refund? Understanding and effectively planning your tax obligations doesn't have to be a painful experience, and as mentioned, could end up being quite beneficial. This article will guide you through essential tax-planning considerations and focus on retirement investment specifics. We’ll also discuss the unique aspects of the South African tax system so that you can feel empowered to get as much money back from SARS as you should.

Know your filing obligations

To start, it's crucial to understand whether you need to file a tax return at all. The rules have changed recently. If you earn less than R500,000 per year solely from a salary, have no other income streams, and your only deductions are those reflected on your IRP5 payslip, you are not required to submit a tax return. However, if you have additional deductions, such as medical aid contributions from a personal scheme or contributions to a pension fund or private retirement annuity (RA), filing a return will likely be beneficial, and understanding how to leverage the tax benefits of your retirement investments to the full is important.

How to build wealth for your children

Every parent wants to leave a legacy for their children, but with everyone shouting at you about tax-free savings accounts, unit trusts and retirement annuities, how should you think about it? We've made it easy. Read more

The power of monthly tax benefits

If your additional deductions don’t reflect on your monthly payslip, you can talk to your payroll department to get them added. This way, your employer will factor these deductions into your PAYE calculations, giving you the tax benefit each month instead of waiting for a potential refund later. This is particularly relevant for medical aid and RA contributions. Remember that to facilitate this, you will need to provide your employer with official documentation from the financial institution or medical aid provider.

An introduction to investments in South Africa [video] - Rands and Sense by 10X

Want to know about offshore investing, property as an asset class, tax-free savings accounts and everything in between? Rands and Sense by 10X is here to help you understand investment fundamentals. Read more

![An introduction to investments in South Africa [video] - Rands and Sense by 10X](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F7qzuglRSuERVXYEw569szC%2Ffd490209f27286680c8f3916f8aac2a0%2FRands___Sense_Podcast_-_Episode_1-2.webp&w=828&q=75)

Understand the silent threat of tax creep

‘Tax creep’ is a subtle yet significant challenge for taxpayers worldwide. It occurs when governments increase their tax revenue without explicitly raising tax rates. This can happen through various mechanisms, such as:

Erosion of the lump sum retirement benefit: The tax-free portion of your retirement savings withdrawal, currently capped at R550,000, is not often adjusted for inflation. This can mean you are effectively paying tax on a larger portion of your retirement funds upon withdrawal, even though the nominal threshold hasn't changed.

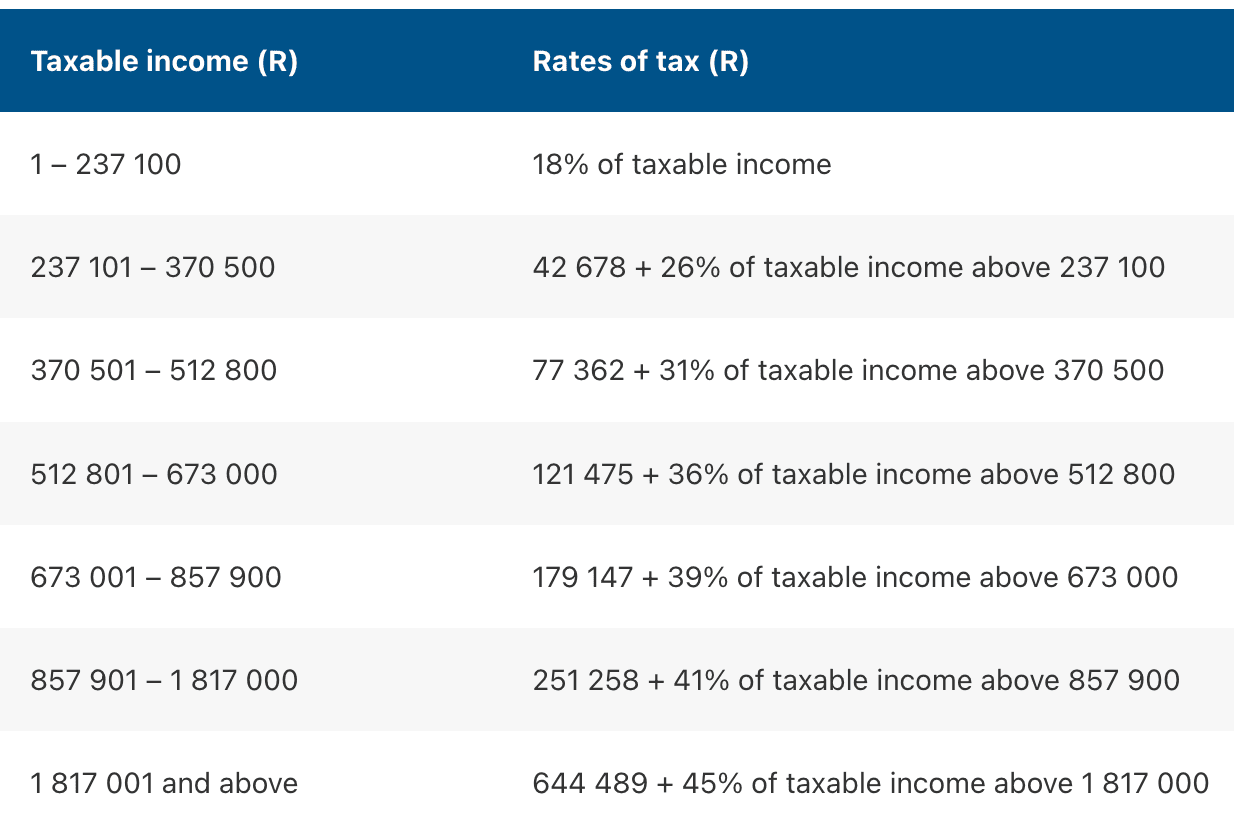

Tax bracket creep: If tax brackets are not adjusted to keep pace with inflation, you might find yourself pushed into a higher tax bracket even if your real income hasn't increased. This results in paying a higher effective tax rate despite no actual improvement in your purchasing power.

Retirement Annuity vs Tax-free Savings Account vs Bond: Where Should Your Extra Money Go?

Got extra money to invest? Compare three powerful options: Retirement Annuity, Tax-Free Savings Account (TFSA), or paying off your bond faster. Learn the pros and cons of each to make an informed choice for your financial future. Read more

Countering the effects of tax creep

While tax creep might seem inevitable, there are ways to mitigate its impact, most notably for the purposes of this article, making strategic use of your retirement annuity contributions.

- Increasing your monthly RA contributions can effectively lower your taxable income, potentially pushing you back into a lower tax bracket and offsetting the effects of tax bracket creep.

- Make an additional voluntary contribution (AVC). Talk to your HR department about directing some of your bonus to your company retirement fund through an AVC. You'll get the tax benefit immediately, and your future self will thank you.

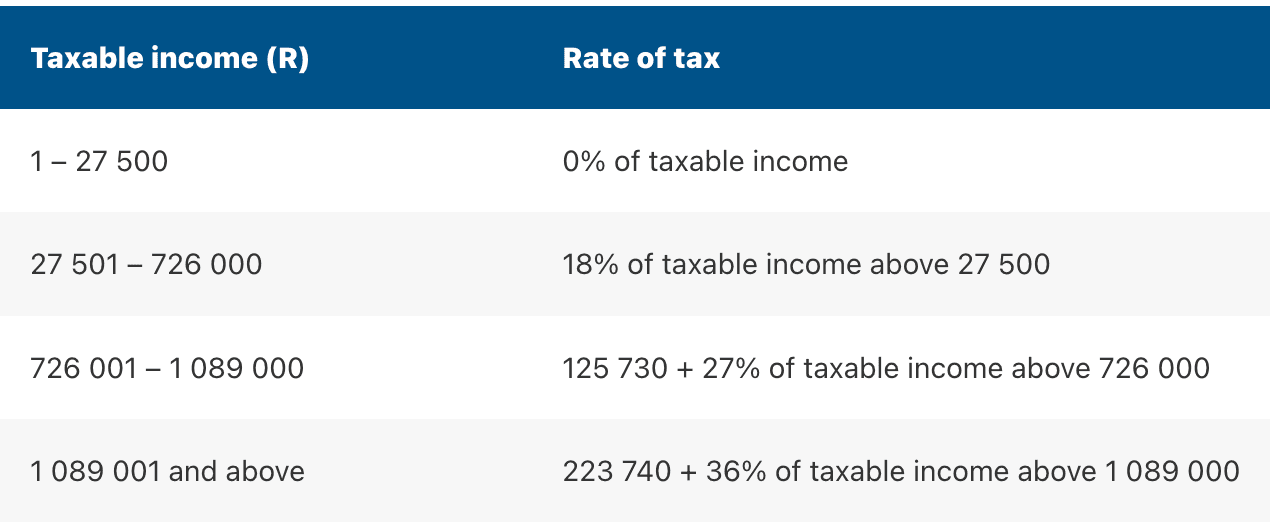

- Preserve your benefits when changing jobs. One of the biggest mistakes people make is cashing out their retirement savings when they move jobs. As you can see from the lump sum withdrawal benefit table below, the tax implications of this are significant, and you will lose all the accumulated potential for significant compound interest on that amount further down the line.

Using your retirement annuity to maximise tax benefits

Your retirement annuity is a great vehicle for helping you get more tax back. Let's start with a practical example.

If you're in the fourth tax bracket below, earning R540,000 per year (R45,000 per month), and you’re contributing 15% of that (R6,750) to a retirement annuity, you stand to save around R26,000 on tax. If you split that up over 12 months, it equates to a tax saving of just over R2000 per month. So, your retirement savings are costing you around a third less than you are actually paying – SARS is effectively helping fund your retirement.

Here's what makes retirement fund contributions particularly powerful:

- You can deduct up to 27.5% of your taxable income or gross remuneration (whichever is higher)

- This applies across all your retirement funds combined (pension, provident, and retirement annuities)

- If you contribute more than the annual limit, these excess contributions roll over to future years

But the benefits don't stop there. When you eventually draw from these savings in retirement, you're likely to pay a lower tax rate than you do now. Want to see exactly how much you could save? Our Tax Savings Calculator can show you the immediate impact on your take-home pay and tax bill.

Tax-free growth: the hidden advantage of retirement annuity savings

While the immediate tax deduction is appealing, there's an even bigger benefit that many people overlook: your investment grows completely tax-free within a retirement fund. Unlike private investments, you pay:

- No tax on interest earned

- No tax on dividends

- No capital gains tax

Currently, Morningstar estimates the ‘tax drag’ on a local high equity portfolio at around 1.2% annually. Retirement fund members don’t pay this tax. When taking the effect of compounding into account, this annual cost saving could translate into as much 30% more money after 40 years. By understanding how the South African tax system can be leveraged to your benefit, staying informed about any changes in legislation, and implementing proactive planning strategies, you can take control of your tax obligations. Tax planning isn’t about avoiding your responsibilities; it's about ensuring you pay what is legally required while maximizing your financial well-being.

9 out of 10 people do better with 10X

The essential checklist for taxpayers

For those earning over R500,000 or having additional income streams, filing a tax return is mandatory. Below are some crucial steps to ensure a smooth and accurate filing process:

Verify your details annually: Double-check your personal information on the SARS eFiling system, including bank details, contact numbers, and address. Incorrect information can cause delays in processing refunds.

List all sources of income: Ensure you account for all your income, including salary, rental income, side hustles, or any other form of earnings. Forgetting even small amounts can lead to penalties later.

Inventory your investments and bank accounts: Keep a comprehensive list of all your investments and bank accounts. This is essential for gathering the necessary tax certificates required for your tax return.

Determine your tax paying status with SARS: Understand whether or not you are a provisional taxpayer. This applies if you have income sources beyond your salary that exceed certain thresholds, requiring you to make tax payments throughout the year.

Keep meticulous records: Maintain detailed records of all your income and expenses, particularly if you are a provisional taxpayer.

Keep your receipts: While photos of receipts are generally alright, SARS might request original documents as proof of your expenses. This is particularly crucial for entertainment expenses, which often require more detailed justification.

Don't just rely on auto-assessment: While SARS provides auto assessments, you don’t need to blindly accept them. Errors in data collection are common, so always double-check the calculations and ensure the information is accurate.

Compare your previous returns: Use your previous year's tax return as a reference point. If your financial situation hasn't changed drastically, the line items should be broadly similar. Significant deviations might indicate a missing income source or expense.

Request a statement of account: After filing your return, request a statement of account from SARS. This document reflects your current tax position, including any outstanding payments, penalties, or refunds due. Ideally, this statement should show a zero balance, indicating that your tax affairs are in order.

Finding your way through the tax year maze: The complexities of the South African tax year can be perplexing, especially for provisional taxpayers who have multiple filing deadlines. Remember, the tax year runs from 1 March to the end of February the following year. Provisional taxpayers have three key deadlines: The first provisional tax payment is due in August of the tax year, the second in February of the following year, and the third (a top-up payment) in August of the following year. Accurately estimating your income and making timely payments throughout the year can help you avoid penalties for underpayment.

The right reference number is crucial. When making payments to SARS, ensure you use the correct payment references. Incorrect references can lead to misallocations, potentially resulting in penalties even if your total payment is correct. Remember to verify your bank details with SARS, especially if you have changed accounts recently. Even seemingly minor changes can create significant issues with refunds.

Finally, it's worth asking yourself whether your retirement annuity itself is actually performing the way you need it to for the retirement you deserve, and whether you're paying too much for your investments. Consider the effects of high fees below, and then compare the performance of your investments to our flagship Your Future fund below that.

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.