Secure financial independence with a direct investment in a 10X Living Annuity

26 November 2024

Moving jobs? How to grow your pension and protect your retirement through career change

Building Confidence for Direct Investment with 10X

These days, more and more retirees are becoming dissatisfied with their current living annuity providers – a problem that can often be boiled down to high advisory fees, the provider themselves having opaque fee structures, hidden costs, and a lack of flexibility with retirement investments.

The fees charged by your living annuity provider, often coupled with substantial advisory fees, can have a significant impact on the growth of your investment. Low fees, on the other hand, can return more money to you by allowing more money to be reinvested, and thereby give you a better chance of growing your capital. High fees are like compound interest working in reverse, eroding your retirement savings over time. Adding to this, many investors have traditionally depended on financial advisors to oversee their living annuities and other retirement investment products, but the fees associated with these advisors compound negatively in a similar way, affecting the overall growth of your retirement savings. Couple all of this with rising inflation rates and you could find yourself in an uncomfortable position, and running the risk of outliving your retirement savings.

10X Investments presents a valuable alternative to this approach, so that you can take control of your retirement plans while keeping pace with (and potentially, outpacing) inflation, and limit the impact of fees in the overall picture. With the right resources, knowledge, and user-friendly tools, managing your living annuity investment independently can be an efficient and rewarding option. By avoiding advisor fees and keeping investment fees low, you’re able to keep more of your money invested to allow the power of compounding to work in your favour. Alongside this, a strategic approach to diversified asset allocation and making sure your drawdowns are sustainable will allow your savings to grow more effectively and propel you towards your retirement goals.

With 10X Investments, you can benefit from low fees and a transparent fee structure, along with complimentary access to experienced consultants and a wealth of portfolio management resources. Our blogs put invaluable information in the palm of your hand, while our easy-to-use tools streamline the way you monitor and adjust your investments. Through our services, you have access to an array of tailored fund solutions designed to suit different financial goals, risk tolerance, and time horizons. In this article, we’re going to break down everything you need to know about direct investing with 10X – from our unique approach to managing your investments, to tools you can use to calculate potential savings and more.

Living Annuities Explained

A living annuity is a retirement savings investment product designed to provide you with a flexible income stream while keeping the bulk of your savings invested, and ideally managed effectively to grow over time. Unlike a life (guaranteed) annuity, which provides a fixed income for life, a living annuity allows you to manage your own investment portfolio, adjust withdrawal rates and payment schedules, and leave remaining capital to beneficiaries. With a living annuity, you can focus on growing your savings through a range of funds with different underlying asset allocations, allowing you to plan on funding your retirement with the returns from your chosen fund while also looking at growing the investment, rather than having a fixed income or depleting your original savings.

Get all your questions on living annuities answered on our living annuity FAQ page.

10X Investments And Our Approach To Retirement Savings

At 10X Investments, there are three pillars to our philosophy – low fees, transparency, and a diversified approach to asset allocation that gives you the best chance at generating a return from high-performing investments.

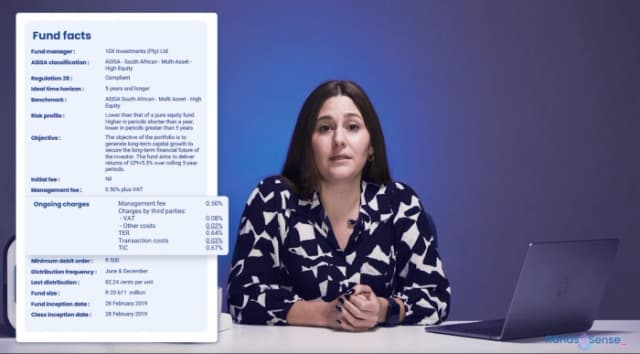

Low-Fees: High fees can eat away at investment returns over time, which is why 10X keeps costs low with a scalable fee structure. As investment amounts grow, fees decrease, ensuring that a greater share of returns stays with the investor, supporting long-term growth. Low fees positively impact the growth of your investments by extending the overall lifespan of your retirement savings, which is aided greatly by a transparent fee structure. At 10X, we do everything we can to eliminate unnecessary fees, and make extensive use of index-tracking to keep our fees as low as possible.

Transparency: We focus on simplicity and transparency with a single management fee, which decreases as your investment grows. There are no upfront, advice, or exit fees, and you won’t encounter pesky hidden costs or penalties for adjusting your investment strategy. We also have highly experienced investment consultants available to you at no cost, to make sure you have all the facts before making life-changing decisions.

Diversified Asset Allocation: We take a structured approach to asset allocation, balancing investments across asset types to optimise returns to outpace inflation by a healthy rate, while effectively managing risk. This involves selecting a strategic mix of equities, bonds, property, and other assets based on market conditions and individual goals, risk tolerance, and time horizons. Diversified asset allocation allows investors to confidently weather market fluctuations and enhances the likelihood of stable returns, reducing the risk associated with any one investment.

Our flagship 10X Your Future Fund is a prime example of our approach, delivering strong returns that consistently outperform benchmarks. This fund provides affordable exposure to diverse local and global assets, focusing heavily on growth assets like equities and property – ideal for investors looking for long-term capital growth to carry them through retirement.

For more information on our funds and their performance, take a look at our funds page. You can also use our living annuity calculator can help you estimate how much monthly income you could receive according to your current age and total retirement savings. With 10X, as mentioned, you also have access to expert investment consultants at no additional cost to you.

Tools To Support Direct Investment And Retirement Planning

At 10X we know that taking the reins and managing your retirement can be a fraught process. That’s why we try to provide resources that help you understand the facts, and expert consultants to answer any questions you might have. We’ve mentioned some of the tools above, but you’ll also find a wealth of knowledge on our blog.

Perhaps most importantly, and because you’ve heard us bang on about fees quite a bit, we provide a couple of ways for you to easily see if you’re paying too much for your investments and whether you could do better with 10X

Use our effective annual cost (EAC) calculator to get a sense of how much you might save (and therefore how much your investments might grow) with 10X

Use our free comparison report to see how we stack up against your current provider in both costs and performance

With the right tools, knowledge, and expertise, you can confidently take charge of your financial future without needing to rely on high-cost advisory services.

Managing The Key Influencers Of Investment Success – Fees, Inflation, And Drawdown Rates

Hopefully, after years of careful planning and dedicated saving, you’re finally ready to retire and looking forward to many years of comfortable living funded by your accumulated retirement savings and living annuity income. Congratulations - if you’ve managed to stay on track with your savings goals, you’re among the few South Africans who are well-prepared for this transition. Now, the focus shifts to making sure your savings last for the entirety of your retirement. To achieve this, it's essential to manage your investments wisely, and you can start by referring to a formula we like to call the "golden equation" of stable retirement finances. It looks like this:

Drawdowns + Fees + Inflation ≤ Return on Investment

The idea behind the golden equation is very simple: your total expenses (including drawdowns, fees, and the impact of inflation) must not exceed the returns your investments generate. This way, running out of money is a mathematical impossibility (please note that we didn’t say it’s easy to do – just that it’s a sound way of looking at your retirement savings).

A Quick Note On Retirement Income: When investing directly and managing your living annuity investments on your own terms, it's also important to shift how you think about retirement. Retirement doesn’t necessarily mean the end of earning an income. There is certainly still room for part-time work and side projects to generate additional income, and this is something that plenty of retirees choose to do – even if they’re earning less than what they made during their careers. Developing a side hustle or taking on freelance or part-time work can be a great way to boost the return side of the golden equation and lower your drawdowns, helping you to further preserve your savings and keep your retirement plan sustainable despite rising inflation rates. Check out our ‘4% Rule’ and ‘Working longer vs Retiring now’ blogs for more information on funding your retirement effectively.

Drawdown Rates

With a living annuity, you have the flexibility to adjust your income to suit your changing financial needs. If your expenses increase in one year, you can raise your drawdown rate to increase your income, and if your needs decrease, you can lower the drawdown rate to preserve your savings. You can make these adjustments annually.

For living annuities in South Africa, the minimum drawdown rate is 2.5%, while the maximum is 17.5%. Within these constraints, it’s a good idea to keep your drawdown as low as possible. The lower this rate is, the more capital you will have in your annuity, allowing the power of compounding to increase your investment’s growth. While a sustainable drawdown rate is generally in the region of 4-5%, the goal is to adjust your income drawdowns as needed, and to try and reinvest any excess you might not urgently require.

A Quick Note On Tax: Another reason to consider lowering your drawdowns is to be taxed at a lower income tax rate. If you are able to live on less than what you’re withdrawing, it’s important to consider the tax benefits of adjusting your withdrawals to potentially put yourself in a lower tax bracket.

Fees

If there’s one thing we’re happy to repeat ad nauseum, it’s that the fees you pay on your investment are just as important as the performance of the funds in which you invest. High fees can hinder the success of your investments, chipping away at investment returns. Did you know a 1% difference in fees can mean up to 30% less money in retirement? This drain on your savings is exacerbated in retirement by unsustainable drawdowns and the potential for rising inflation rates, and if all three are not taken into account, you could risk running out of money.

Inflation

Inflation is always an important consideration when planning for the future. In South Africa, the inflation rate is currently between 5 and 6% annually. This means an amount of money today has 5-6% more buying power than that same amount of money would have in a year’s time. Ultimately, investments earning less than this are losing investors money every year. Inflation and fees corrode your investment capital when together they are higher than your ROI (and we haven’t even added the additional effect of drawdowns). When it comes down to the Golden Equation, inflation is always going to be the one factor you don’t have control over – however, the negative effects of inflation can be combatted with strategic and diversified asset allocation within the right fund for your investment goals and time horizon.

Portfolio Management And Investment Strategies

Managing your living annuity investment without a financial advisor is entirely possible when you have the right tools and resources on hand. There are a few crucial details to keep in mind when it comes to asset allocation and keeping up with inflation. Striking the right balance in your portfolio based on yourtime horizon, risk tolerance, and financial needs is key.

By balancing risk and growth potential in your investment portfolio, you will be better equipped to achieve your long-term financial goals while mitigating potential drawbacks. There are a few factors to consider in order to achieve this ideal balance:

Assessing risk tolerance is the first step you can take, and this means you should understand your comfort level when it comes to fluctuations in the value of your investments. How much risk are you willing to weather, and how much risk will you need to take on in order to achieve your retirement income goals? A common mistake retirees make is becoming overly conservative with their investments too early.

While shifting towards safer assets might feel like a prudent move, you may not be able to generate sufficient returns to meet your income expectations and keep up with rising inflation rates. This is why mapping out your time horizon and maintaining a long-term perspective is key. You’ve also got to stay on top of the performance of your investments. Determining your time horizon, allocating assets accordingly, and sticking to your guns can help you navigate short-term market volatility with peace of mind. It’s about the long game, after all!

Ideally, you want to capitalise on the growth of your investments over time to bolster your retirement income. A longer time horizon can support a more growth-orientated strategy, and then, as you transition through retirement, you can gradually shift your focus to capital preservation by changing your underlying asset structure from a higher percentage of growth assets like equities, to a higher percentage of defensive assets like cash and bonds, for example.

In the same vein, the next aspect to consider is diversification, which involves spreading your investments across assets such as property, bonds, stocks, and cash, which helps reduce concentration risk should one of these asset classes underperform in the short term. An effective asset allocation strategy not only aims for consistent growth but also helps shield against inflation, preserving your purchasing power and supporting financial stability throughout retirement. By carefully managing and adjusting your investment mix with the help of our investment consultants, you can navigate market ups and downs while ensuring that your portfolio aligns with your income goals.

Diversification plays a key role by spreading investments across various asset classes, economic sectors and geographic regions, which can help mitigate risk. For example, 10X funds have different offshore and local asset allocations, tailored to different levels of risk tolerance and investment timeframes, which is one part of providing the right fund to align to your financial objectives and comfort with market volatility.

Switching Living Annuity Providers

An increasing number of retirees are switching away from traditional living annuity providers, with many citing high investment and advisory fees, a lack of transparency, and limited control over their investment options as the main reasons for this shift.

As we discussed earlier, fees on the one hand, and fund performance on the other, are crucial to maximising your investment returns – which is exactly why 10X focuses on both (and of course, we pride ourselves on exceptional client service as well). Not only do we operate with low fees and a transparent fee structure, but we empower you with information and experienced consultants. Finally, we take all the pain out of switching, with a simple, streamlined process that clients appreciate.

We know its no small thing for you to switch providers, so before you take any steps, do your homework. Get your effective annual cost from your broker or provider, use our EAC calculator, and do a free comparison report with us. Then put our consultants to the test.

Take Control of Your Financial Future

With the right knowledge and tools, it’s possible to confidently invest without the help of a financial advisor. If you’re ready to start maximising your investment potential and benefiting from a direct, transparent, low-fee, high performance approach to your long-term financial goals, get in touch with one of our consultants and 10X your future, today.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.