We've built the 'happy retirement' machine

7 March 2025

The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]

We sit down with 10X Investment Consultant lead Andre Tuck and discuss the retirement savings crisis in South Africa. We also delve into living annuities, retirement annuities, TFSAs and everything in between. Read more

![The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F5ipSTnRq5Dp25fyghm5kGQ%2F02c801c78d5e1ca9280bfd34d7602368%2FAndre_Tuck_podcast_cover_image__1_.webp&w=828&q=75)

First, understand that you’re a victim of sensationalism

Only 6% of South Africans can maintain their standard of living in retirement. This isn't just a problem of insufficient savings. Even diligent savers who consistently contribute to retirement vehicles often fall short of their goals. The question is: why?

And the short (and uncomfortable) answer is: you’ve been distracted by loud headlines and industry narratives.

Open any financial publication or listen to any investment podcast, and you'll hear endless discussions about individual stocks. Which technology company will dominate the next decade? Which bank is positioning well for rising interest rates? Should you invest in the latest renewable energy IPO?

It’s all very engaging, but when it comes to your investments, it’s mostly all noise.

Decades of academic research and practical investment experience point to an inconvenient truth: approximately 90% of long-term investment returns come from asset allocation decisions, not individual security selection.

What does this mean? Simply that, over time, the decision of which groups of assets (equities, bonds, property, cash, commodities) to invest in, and when to change the mix of assets you’re invested in, is the most important contributor to your investment success.

If you're unsure of the asset allocations in your retirement annuity or living annuity, you can get the facts from our experienced investment consultants, completely free of charge.

Yet the investment industry continues to charge premium fees for stock-picking expertise and market timing skills that historically fail to deliver consistent outperformance after costs. According to research by S&P Dow Jones Indices, the majority of active managers underperform their benchmarks over time spans of 10 years or more – regardless of geography or market conditions.

You might be able to get more from your investments. If you're worried about your investment's performance, you can get a free comparison report from 10X.

9 out of 10 people do better with 10X

Three investment principles that will give you a great chance at the retirement you want

If stock picking isn't the answer, what really determines investment and retirement success? Research points to three fundamental principles:

1. Strategic asset allocation

Put simply: Your investment manager should understand which mix of assets provides the best chance of long-term growth

The mix of growth assets (equities) and defensive assets (bonds, cash) in your portfolio, along with the balance between domestic and international exposure, will determine the vast majority of your returns. This isn't just about choosing a risk profile and forgetting about it – it requires thoughtful adjustment as market conditions and valuations change over time.

2. Cost-effective implementation of the asset allocation strategy

Put simply: Your investment manager shouldn’t be paying more than they absolutely need to in order to invest your money

Once an investment manager has determined the right asset allocation, accessing those asset classes efficiently becomes critical. The evidence consistently shows that well-constructed and diverse index funds outperform most active managers over time, primarily due to lower costs (constantly buying and selling incurs trading costs that add up) and broader diversification that reduces single-company risk.

3. Managing your investment costs

Put simply: You shouldn’t be paying high fees to your investment manager

The mathematics of compounding makes cost management one of the few certainties in investing. A 0.5% reduction in annual fees could translate to approximately 20% more money in retirement over a 40-year investment horizon. For most investors, costs are far more controllable than returns, so you should be controlling yours.

Compare your retirement investments

Effective annual cost calculatorThe pendulum always swings back: understanding mean reversion in markets

Beyond the three principles listed above lies a powerful concept that some investors recognise but many funds fail to properly appreciate: mean reversion.

Markets have their own version of gravity. When asset classes stretch too far from their long-term averages – either to the upside or downside – they tend to revert back over time. Think about a pendulum: whether it swings to good times or bad, it’s going to swing back the other way at some point.

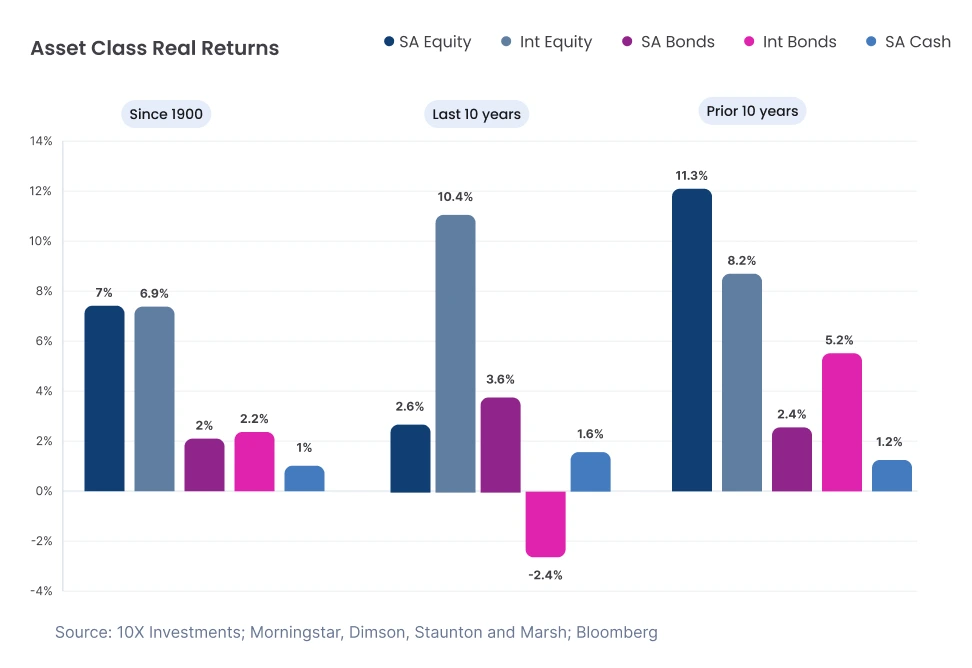

Consider this reality: asset classes frequently deliver returns that diverge significantly from their long-term averages over periods as long as a decade. International equities, for example, delivered 11% more than inflation over the past decade – substantially higher than its long-term average of 6.5%. But in the preceding decade, that asset class only delivered 3% more than inflation.

This pattern repeats across asset classes and time periods. What performs exceptionally well over one decade often struggles in the next, and vice versa.

Building blocks to a lasting Living Annuity

Our panel of experts discusses living annuities, sustainable drawdown rates, offshore investing, and everything else one might need to consider to ensure a comfortable retirement. Read more

![Building blocks to a lasting Living Annuity [webinar + transcript]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F4dZzwtwSkZ19hmRrVa6Zyb%2F770741ecc4b2ae3deda48fa06da42718%2FWebinar_recording_cover_1920X1080.webp&w=828&q=75)

The trouble with equities: how a company is viewed now and how it is likely to perform in future are two different things

The relationship between current valuations and future returns isn't just theoretical – it's backed by hard data. When investors bought U.S. equities at the peak of the dot-com bubble in December 1999, they experienced negative real returns for the subsequent decade. Conversely, those who invested at the bottom of the Global Financial Crisis in March 2009 enjoyed real returns of approximately 15% per annum for the following ten years.

This creates a profound disconnect between what has recently performed well (which attracts investor attention and capital) and what is likely to perform well going forward (which often receives less attention precisely when it should receive more).

What does this mean for your retirement investments? Simply that you should be wary of betting the house on what’s hot right now. Rather, consider what is likely to perform in the long term (because saving for retirement, and retirement itself, is a long-term game).

The "Buy to Hold" alternative

Given these realities, what approach best serves retirement investors?

Traditional passive investing – buying market indices at their current weights and holding regardless of valuations – ignores the powerful reality of mean reversion. Meanwhile, active management typically charges high fees for stock-picking expertise that rarely delivers sustainable outperformance.

A more effective middle path combines the efficiency of index investing with respect for valuation principles. You could call this a "buy to hold" approach:

- Construct portfolios today as if you're buying to hold for the next five years

- Regularly reassess forward-looking expectations based on changing valuations

- Make thoughtful adjustments when the 5-10 year outlook changes significantly

This approach strikes a balance between rigid passive investing and hyperactive trading. It doesn't attempt to predict short-term market movements and respects the long-term relationship between price and value. For a practical example of these principles in action, check out our flagship 10X Your Future Fund.

Money mistakes to avoid during retirement

Retirement should be a time for relaxation. These tips will help you reduce the stress of your golden years, and retire better! Read more

Ok, but short-term performance is also important!

It’s true that even the soundest long-term strategy can face periods of underperformance that test investor resolve. We address this by setting clear limits on how far we deviate from our long-term benchmark. This disciplined approach helps avoid extreme underperformance that might lead investors to make emotional decisions at precisely the wrong moment.

For example, our current more cautious stance on U.S. equities has created some short-term performance headwinds. But by maintaining diversification and respecting our risk parameters, we've kept performance within an acceptable range while also positioning for better long-term outcomes.

In the end, you should be satisfied by results, not narrative

The ultimate test of any investment philosophy is whether it delivers results over a long time horizon. Our approach has delivered more than inflation-beating returns for our clients for over 17 years, with over 40,000 South Africans now trusting us with their retirement savings.

More importantly, it has delivered these results with less volatility than many competitors who chase returns through concentrated stock positions or tactical market timing – approaches that often lead to boom-bust performance patterns.

We invite you, the South African investor, to approach what to do with your money differently – to look beyond engaging stories about individual companies and focus on the fundamental drivers of long-term returns.

In a world where investment content often resembles entertainment rather than analysis, an evidence-based approach offers something valuable: a higher probability of reaching your retirement goals.

If you feel your investments could be doing more for you, get the facts from an experienced 10X investment consultant, completely free of charge.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.