How to use your retirement annuity to pay less tax (and get more back from SARS)

8 January 2025

An introduction to investments in South Africa [video] - Rands and Sense by 10X

Want to know about offshore investing, property as an asset class, tax-free savings accounts and everything in between? Rands and Sense by 10X is here to help you understand investment fundamentals. Read more

![An introduction to investments in South Africa [video] - Rands and Sense by 10X](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F7qzuglRSuERVXYEw569szC%2Ffd490209f27286680c8f3916f8aac2a0%2FRands___Sense_Podcast_-_Episode_1-2.webp&w=828&q=75)

With tax season approaching, you might be wondering how to make your money work harder for your future while reducing your tax burden today. If you're a working professional juggling multiple financial priorities, understanding the tax benefits of retirement savings could be your secret weapon for building long-term wealth, and all that without significantly impacting your current lifestyle.

Build the retirement of your dreams with our

Retirement Annuity calculatorAnd while we’re talking about your retirement savings, how have yours been doing lately, and do you know if you’re paying too much for whatever you’re getting? Retirement annuity investments in particular have a reputation for being overpriced and poorly managed. Did you know you can get a free, no-strings-attached comparison report from 10X to see if your investments could be doing better?

9 out of 10 people do better with 10X

Smart tax planning for your retirement savings

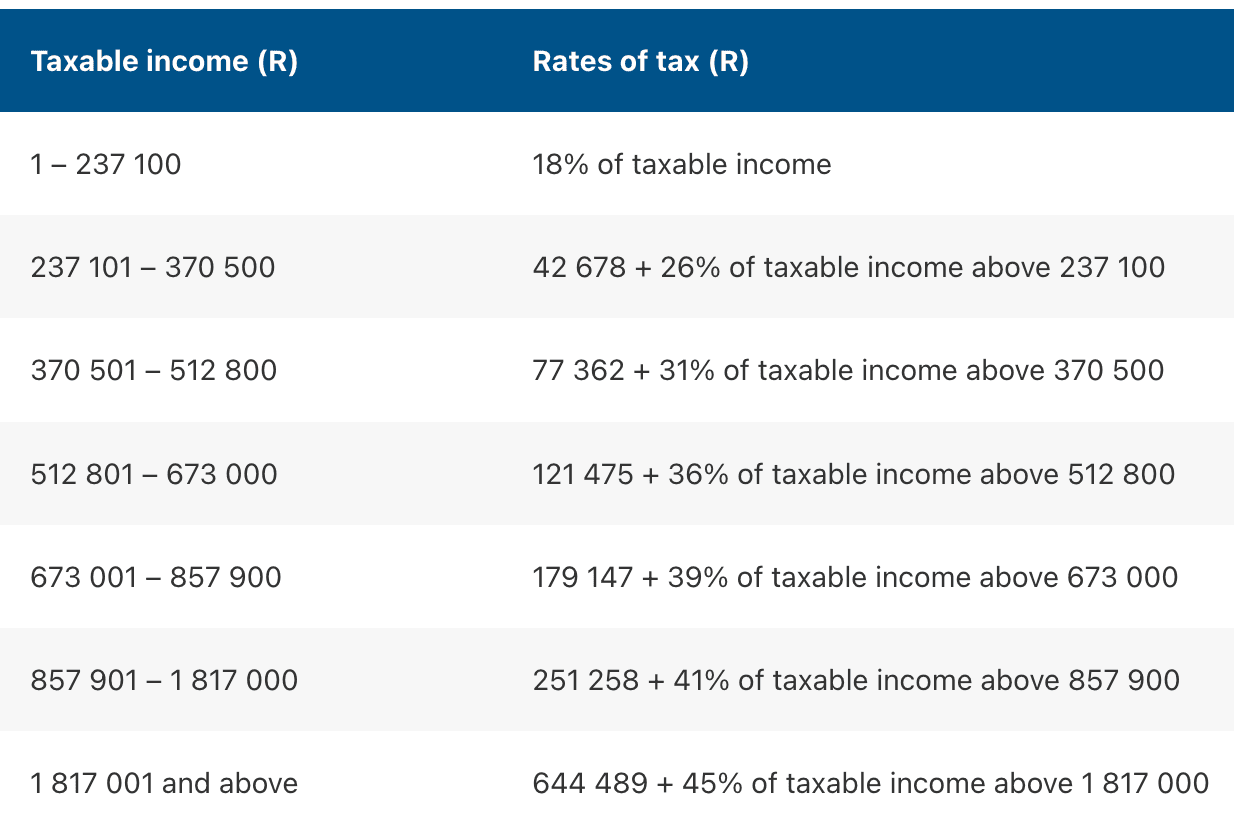

Let's start with a practical example. If you're in the fourth tax bracket below, earning R540,000 per year (R45,000 per month), and you’re contributing 15% of that (R6,750) to a retirement annuity, you stand to save around R26,000 on tax. If you split that up over 12 months, it equates to a tax saving of just over R2000 per month. So, your retirement saving is costing you around a third less than you are actually paying – SARS is effectively helping fund your retirement.

Here's what makes retirement fund contributions particularly powerful:

- You can deduct up to 27.5% of your taxable income or gross remuneration (whichever is higher)

- This applies across all your retirement funds combined (pension, provident, and retirement annuities)

- If you contribute more than the annual limit, these excess contributions roll over to future years

But the benefits don't stop there. When you eventually draw from these savings in retirement, you're likely to pay a lower tax rate than you do now. Want to see exactly how much you could save? Our Tax Savings Calculator can show you the immediate impact on your take-home pay and tax bill.

Retirement Annuity vs Tax-free Savings Account vs Bond: Where Should Your Extra Money Go?

Got extra money to invest? Compare three powerful options: Retirement Annuity, Tax-Free Savings Account (TFSA), or paying off your bond faster. Learn the pros and cons of each to make an informed choice for your financial future. Read more

Tax-free growth: the hidden advantage of retirement annuity savings

While the immediate tax deduction is appealing, there's an even bigger benefit that many people overlook: your investment grows completely tax-free within a retirement fund. Unlike private investments, you pay:

- No tax on interest earned

- No tax on dividends

- No capital gains tax

Currently, Morningstar estimates the ‘tax drag’ on a local high equity portfolio at around 1.2% annually. Retirement fund members don’t pay this tax. When taking the effect of compounding into account, this annual cost saving could translate into as much 30% more money after 40 years.

The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]

We sit down with 10X Investment Consultant lead Andre Tuck and discuss the retirement savings crisis in South Africa. We also delve into living annuities, retirement annuities, TFSAs and everything in between. Read more

![The uncomfortable truth about retirement in South Africa - Rands and Sense by 10X [video]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fyqvz0zwovkbq%2F5ipSTnRq5Dp25fyghm5kGQ%2F02c801c78d5e1ca9280bfd34d7602368%2FAndre_Tuck_podcast_cover_image__1_.webp&w=828&q=75)

Smart strategies to boost your tax benefits

If you receive an annual bonus or 13th cheque, here's a tax-smart approach to consider:

Additional voluntary contributions (AVCs)

Talk to your HR department about directing some of your bonus to your company retirement fund through an AVC. You'll get the tax benefit immediately, and your future self will thank you.

Top up your retirement annuity

Don't have an AVC option? Consider using your bonus to boost your RA instead. The tax benefit works the same way.

Preserve your benefits when changing jobs

One of the biggest mistakes people make is cashing out their retirement savings when they move jobs. The tax implications are significant:

By preserving your savings in a preservation fund, you keep both your money and its tax advantages working for you. Furthermore, you give yourself more time for compound interest to work for you. It’s incredibly difficult to ‘get back’ the years during which you were contributing to your company retirement fund. Withdrawing early means it's much less likely that the real effects of compounding (from about year 20 onwards) do their best work for you.

See your pension savings grow with our

Preservation Fund calculatorOk, you want to be tax-savvy, so what to do next?

- Verify your details annually: Double-check your personal information on the SARS eFiling system, including bank details, contact numbers, and address. Incorrect information can cause delays in processing refunds

- List all sources of income: Ensure you account for all your income, including salary, rental income, side hustles, or any other form of earnings. Forgetting even small amounts can lead to penalties later.

- Determine your tax paying status with SARS: Understand whether or not you are a provisional taxpayer. This applies if you have income sources beyond your salary that exceed certain thresholds, requiring you to make tax payments throughout the year

- Don't just rely on auto-assessment: While SARS provides auto assessments, you don’t need to blindly accept them. Errors in data collection are common, so always double-check the calculations and ensure the information is accurate

- Compare your previous returns: Use your previous year's tax return as a reference point. If your financial situation hasn't changed drastically, the line items should be broadly similar. Significant deviations might indicate a missing income source or expense

- Request a statement of account: After filing your return, request a statement of account from SARS. This document reflects your current tax position, including any outstanding payments, penalties, or refunds due. Ideally, this statement should show a zero balance, indicating that your tax affairs are in order

- The right reference number is crucial. When making payments to SARS, ensure you use the correct payment references. Incorrect references can lead to misallocations, potentially resulting in penalties even if your total payment is correct. Remember to verify your bank details with SARS, especially if you have changed accounts recently. Even seemingly minor changes can create significant issues with refunds.

Know where you stand with your retirement annuity

- Use 10X's Retirement Annuity Calculator to check if you're on track for a comfortable retirement.

- Compare your investment costs. High fees can eat into your returns just like taxes do. Use our EAC calculator to get a handle on how much you’re actually paying to invest for retirement, or get a free Comparison Report to see if you could be saving on fees.

- Talk to a retirement expert .Our investment consultants have been giving thousands of South Africans the facts about their retirements for over a decade. They can help you understand how to structure your contributions for maximum tax efficiency – and unlike your financial advisor, there’s no cost associated with speaking to them.

Smart tax planning through retirement savings isn't just about paying less tax today – it's about making your money work harder for your future. By understanding and maximizing these benefits, you're not just saving on tax; you're building a more secure retirement. Ready to make your money work smarter and harder? Speak to a 10X Investment Consultant today.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.