How To Choose The Right Investment Strategy For Your Retirement Annuity

6 July 2024

Moving jobs? How to grow your pension and protect your retirement through career change

When putting plans in place to secure a comfortable retirement, if you do not have a company pension or provident fund (or even if you do, but want to save more), retirement annuities are a great way to help you prepare for the future. In a nutshell, retirement annuities involve investing a portion of your salary into a financial instrument that is regulated by Regulation 28 of the Pension Act. The investment provider you choose then uses those funds to invest in a mix of assets – usually equities, bonds, property and cash. Over time, this investment grows, and can then be converted into a living or life (guaranteed) annuity – providing you with a steady income upon retirement. A 10X Retirement Annuity can set you up for success, allowing you to invest with confidence and peace of mind.

Keep reading to get clued up on topics such as life stage investment strategies and how they work, how to choose the right retirement annuity to fit your needs, how to vet providers, how to address scams, and – critically – how to avoid them. Our goal at 10X Investments is to equip you with all the knowledge you need to make an informed decision about your retirement savings.

Retirement Annuities: A Brief Breakdown

So, what exactly are retirement annuities? A retirement annuity is a financial product designed to provide you with a livable income once retired. In other words, it’s a long-term investment in your future. To generate this income, the annuity provider invests your contributions into various financial assets. These underlying funds include instruments like stocks, bonds, cash, and other assets, the sum of which make up your retirement annuity. The idea is to create a portfolio with a good balance of risk versus return in order to meet your future retirement goals.

Retirement annuities do offer investment flexibility, which means you can adjust your contributions as your income fluctuates over the years. At 10X, our clients are free not only to change their contributions, but to take a hiatus from contributions for a few months if needed. Once you reach retirement age, your retirement annuity will need to be converted into a living annuity or life (guaranteed) annuity, after which you will begin to receive a regular income, the range of which is stipulated by you and is legislated to be between 2.5% and 17.5%. It’s good to remember that drawing income sustainably is dependent on the performance of each underlying fund, the fee structure of the investment, and the impact of inflation, which must be factored into your retirement planning.

Notably, retirement annuities are creditor-protected, which means assets are kept safe from creditors in the event of bankruptcy or financial distress. Moreover, annuity contributions are tax-deductible, and the growth on the investment is completely tax-exempt for as long as the investment gains stay within the retirement annuity fund. This tax advantage allows your investment to grow more efficiently, leading to greater income stability in retirement.

The growth of the investment is hugely impacted by time: the longer you are invested, the longer you can take advantage of the effect of compound interest. With previous interest payments being reinvested into the fund and the amount that generates interest continually growing, the gains made over decades can be staggering. The key is to invest early and be consistent with your contributions to make your retirement annuity work in your favour. Ultimately, retirement annuities are powerful financial products that offer a strategic way to ensure that you have a reliable income source in your golden years, allowing you to enjoy retirement without financial stress.

Comparing Providers For Retirement Annuities

When comparing different annuity providers, it’s crucial to assess the potential fees you’ll be charged, as well as the reputation and financial strength of the financial institution, to ensure you make a sound investment decision.

Fees

As mentioned, fees can have a significant impact on your retirement savings. In fact, a mere 1% reduction in fees can result in 30% more money in retirement. Choosing a provider with low fees is essential to maximise your returns. It’s also important that the company is transparent about these fees.

Reputation

When comparing different annuity providers, a good signal is the trust placed in them by corporate clients who typically have large employee pension funds to manage. At 10X, for example, we’ve already earned the trust of established businesses like Deutsche Bank, DHL, Isuzu, Virgin Active and Lindt.

Positive recognition from industry peers is another green flag, and at 10X we’ve achieved awards such as the Balanced Fund Manager Of The Year, Employee Benefit Administrator Of The Year, Technology Provider Of The Year and the Best Investment Practices award.

Recognition from corporate clients and the industry is one thing, but there are plenty of people just like you who have good things to say about us, too! Want to hear it from the horse's mouth? Check out what our clients say about us.

Security And Compliance

You can also look into the results of independent audits and assessments to discern if a provider’s funds are secure and well-managed. 10X is proudly backed by Old Mutual Private Equity and DiGAME. We are also regularly audited by external companies PWC and Investec.

To determine which annuity provider is best for you, we’ve outlined some key questions to ask before making any concrete decisions:

- What is the Effective Annual Cost associated with this annuity?

- How do these fees compare to other annuity providers?

- What is the company’s track record for customer service and satisfaction, and is this reflected in platforms like HelloPeter and Google reviews?

- How is my investment protected if the company faces financial difficulties?

- How do their funds perform compared to industry benchmarks?

- How often is fund performance reviewed and adjusted?

By asking these questions, you will gain a comprehensive understanding of each annuity provider’s offerings, costs, stability, and performance – so that you can make a well-informed decision.

10X Retirement Annuities And Funds

Our clients tell us that what sets the 10X Retirement Annuity apart from other providers are our incredibly low fees and ease of use. The other big differentiating factor is the performance of our underlying funds. Transparency and simplicity in fee structures are highlights for sure, but it’s the robust historical performance of our various funds that truly sets us apart and keeps our client’s money safe, and in many cases, increases it.

At 10X we focus on strategic asset allocation, diversification, and low costs to deliver consistent long-term growth:

- We employ a disciplined approach to asset allocation; carefully balancing investments across various asset classes to maximise returns while still managing risk effectively. This strategy involves choosing the appropriate mix of equities, bonds, property, and various other assets based on market conditions and investor goals.

- Diversification is another cornerstone of our investment philosophy. Spreading investments across different sectors, regions, and asset types, reduces the impact of market volatility on an underlying fund. This approach enhances the potential for steady returns and mitigates the risk of significant losses from any single investment.

- Lastly, we strive to keep our fees low. High fees are notorious for eroding investment returns over time, which is why we implement a progressive fee structure that decreases costs as investment amounts increase. This route ensures that a larger portion of returns stays with the investor, boosting long-term growth.

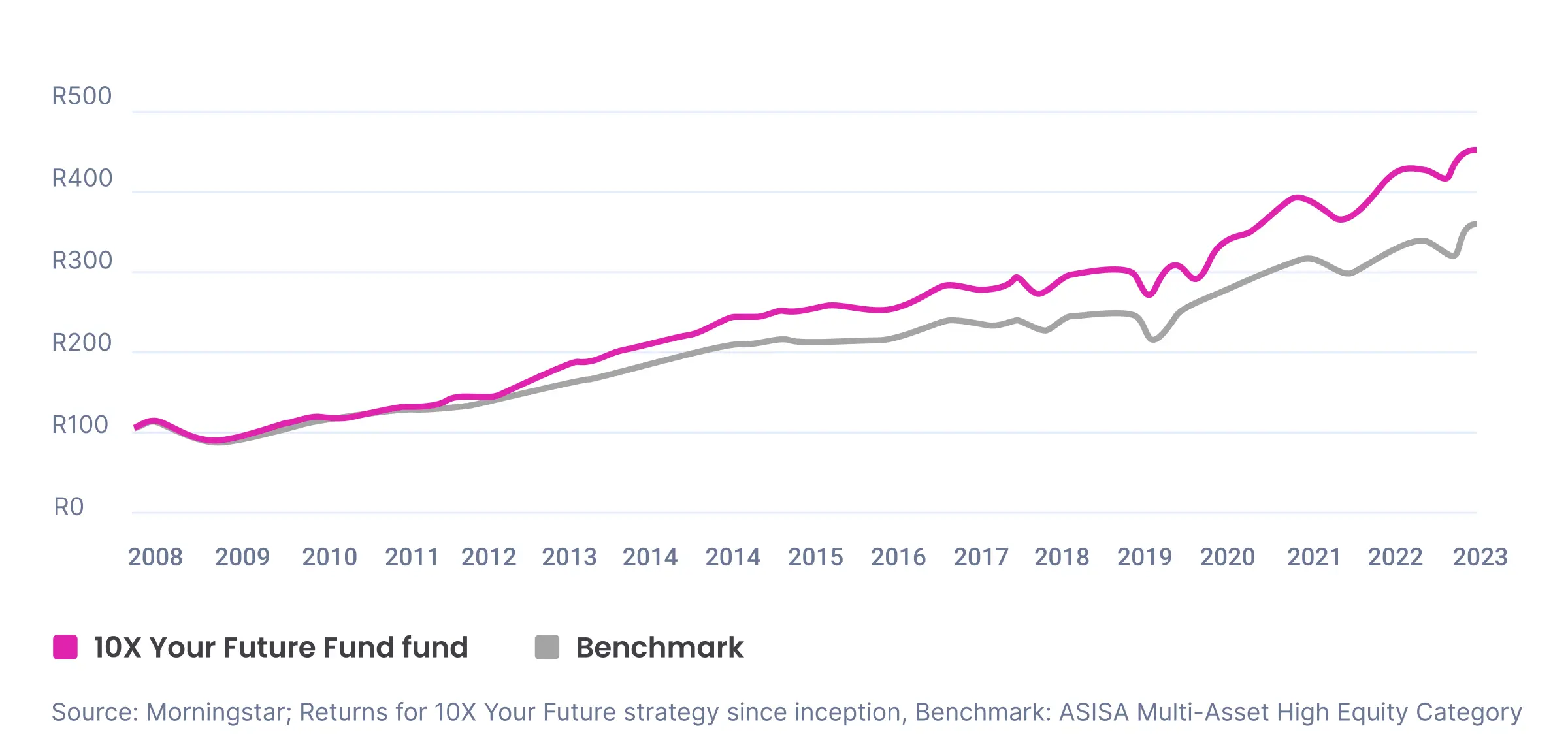

A great example of superior performance and effective risk mitigation is our flagship 10X Your Future Fund which boasts consistent benchmark-beating returns. Structured to provide cost-effective exposure to a broad range of local and international asset classes, this fund focuses heavily on growth assets like equities and property, making it suitable for investors aiming for long-term capital appreciation – but more on that later.

For a detailed analysis of our underlying funds and their performance, take a look at our funds page. To see how we compare to your current provider (usually, quite well in our experience), you can visit our cost comparison report page. Our Retirement Annuity Calculator can also help you understand what contributions you would need to make to retire comfortably.

Life Stage Investment Strategies For Retirement Annuities

Choosing a suitable fund with the right mix of assets has a lot to do with where you are in your life. Typically, investment strategies vary according to the different stages of your life, each tailored to a suitable risk tolerance. In the context of retirement annuities, life stage investment models are typically designed to align the investment portfolio with the investor’s age and retirement goals, often shifting towards lower-risk investments as retirement gets closer.

A few key considerations for life stage investing include time horizons, risk tolerance, specific financial goals, and prevailing market conditions. Longer time horizons allow for more aggressive growth strategies, while shorter time horizons often require a focus on capital preservation. Risk tolerance varies by individual, influencing asset allocation adjustments. Financial goals – including retirement income needs and lifestyle aspirations – also shape the investment approach. Lastly, current and anticipated market conditions play a critical role in determining the ideal asset allocation at different life stages.

- People in the early career stage, between their 20s and 30s, have a high risk tolerance as they have years ahead of them for their investments to grow. They also have more time to recover from financial distress or market downturns. Because of this, an appropriate investment strategy usually focuses on capital growth and allocates more funds to growth assets like equities and property. People in this life stage benefit from the high returns typically associated with riskier assets, but will also experience amplified effects from market downturns.

- In one’s 40s and 50s, during the mid-career stage, risk tolerance is reduced to a moderate level. This is the time when growth remains important, but preserving the wealth already accumulated is a priority, too. In this life stage, it is usually best to have a balanced mix of both defensive and growth assets.

- In one’s 50s and 60s, the focus should be on ensuring a stable portfolio. At this time, investment managers typically advocate for allocating more funds to defensive assets like bonds and cash in order to safeguard your savings.

- Finally, around retirement age in the 60s and beyond, risk tolerance is very low. At this time, the key objective is income generation and capital preservation. Retirees are often advised to prioritise low volatility in their portfolios and a consistent stream of income.

Ultimately, and regardless of your life stage, you want to be comfortable in retirement and not run the risk of running out of capital. This is why it’s critical to find the right annuity provider to help you navigate the intricacies of your investments and your approach to retirement planning.

10X Your Future Fund

Our flagship 10X Your Future Fund offers a comprehensive solution to building your wealth and reaching your long-term financial goals. Aimed at providing you with long-term capital appreciation through a diversified portfolio of local and international assets like equities and property, the returns on the 10X Your Future Fund consistently out-perform industry benchmarks. Key features include:

- Risk Profile: High

- Ideal Time Horizon: 5 years and longer

- Annualised Returns Since Inception: 12.1%

- Fund Size: ZAR 19.1 billion

- ASISA Classification: SA - Multi Asset - High Equity

With average annualised returns of 12.1%, our 10X Your Future Fund exceeds the ASISA Benchmark of CPI + 5.5%. It has also historically outperformed the majority of high-equity multi-asset funds which usually target similar returns.

The 10X Your Future also offers a low fee structure with total fees notably lower than the industry average. For more details on our free structure, read below:

- First ZAR 500,000: 1.04% per annum (including VAT)

- Next ZAR 500,000: 0.92% per annum

- Next ZAR 4 million: 0.81% per annum

- Next ZAR 5 million: 0.58% per annum

- Above ZAR 10 million: 0.40% per annum

- Trading Costs: Between 0.12% and 0.18% per annum depending on the specific fund

Our low fee structure contributes directly to higher net returns for our investors, with total investment costs for funds starting as low as 1.04% per annum for investments up to R500,000. This is far lower than the industry average where total fees often exceed 3% annually.

Avoiding Annuity Scams

Unfortunately, over the years, retirement annuities have become a target for various scams, fraud, and misleading sales practices. Luckily, all you need to avoid these scams is to equip yourself with the right information.

- A common red flag is promises of exorbitantly high returns with no evidence to back up the claim. It’s important to remember that no responsible investment company would guarantee incredible (or any!) returns when, in reality, these are determined by market movements sometimes influenced by completely novel macro factors (like the Covid epidemic). If an opportunity sounds too good to be true – and promises to double or triple your money quickly, for example – it’s more than likely a scam.

- If a company demands you pay fees upfront, don’t do it. Fees are generally deducted from your investment, so don’t be fooled if a company makes these unusual demands.

- Another red flag is a company pressuring you to decide quickly. Scammers usually do this to keep you from conducting your own research and making an informed decision. Don’t let them rush you into anything.

- Making your first contribution almost always marks the last step in the investment process, long after you’ve provided information and documents, been thoroughly vetted, and completed the FICA process. Any company that requests payment before FICA approval is most likely a scammer.

- Finally, WhatsApp scams are becoming particularly common in South Africa. If you receive communication from a private phone number or a free email service like Gmail, proceed with caution. A legitimate company will contact you from an email address attached to their official domain name.

- Scammers have become very savvy at creating communications that look legitimate at first glance. Keep an eye out for email addresses that look similar to your bank’s address but differ by one letter or number. For example, john@10X.co.za is slightly different to john@10.X.co.za. Watch out for small discrepancies like these.

Jean van Niekerk, who heads the ASISA Forensic Standing Committee, reports that members have observed a significant increase in fraud through social media platforms like WhatsApp and Telegram. Scammers in South Africa have also been known to create fake marketing materials using the logos of well-known companies, complete with stolen photographs of trusted banking executives and falsified testimonials.

People are quick to go to social media to find out if these companies are real or not, but this is not advisable either. If you want to be certain an investment opportunity is legitimate, it’s always best to get in contact with the real company before handing over any money.

- Do not respond to financial communications on Telegram.

- If you are asked to finalise a transaction via Telegram, do not comply.

- Do not follow links that ask you to log in or share personal details via WhatsApp, Telegram, or any other social media platform.

- Do not pay any advance fees in order to realise promised returns. Legitimate investment products do not require this.

- If you are charged with premiums for a product you did not sign up for, report it immediately.

You can report potential fraud with established financial institutions or simply notify your local authorities. Retirement annuities are crucial for securing a stable income in retirement, which is why it’s critical to find a reputable and transparent annuity provider. You will be making contributions for decades, potentially, so avoiding scams is of the utmost importance.

We encourage you to conduct thorough research before committing to any financial agreement, especially an annuity, and don’t be afraid to reach out to financial advisors to equip yourself with the right information. You could also speak to multiple advisors in order to get differing opinions and make an informed decision.

For more information on 10X Investments’ retirement annuities and our underlying funds, don’t hesitate to get in touch with one of our trusted consultants. Take a look at our various resources to learn a little more about 10X and why thousands of South Africans choose to invest with us.

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.