How fees affect your preservation fund

19 November 2024

A preservation fund is a retirement savings investment product that allows you to transfer your pension or provident fund savings when leaving a job, without incurring immediate tax penalties. While simply withdrawing your funds would halt your retirement savings growth and trigger taxation, preservation funds allow for a tax-free transfer, all the while maintaining the momentum of your retirement savings.

By opting to preserve your savings instead of cashing out, you can make sure that your retirement savings can continue to grow with maximum compound interest until retirement rolls around. In short, preservation funds offer tax efficiency, flexibility during and after job transitions, and the convenience of investing pension or provident savings from different employers over time.

Keep in mind: You can only transfer funds from one pension or provident fund into a single preservation fund; you cannot keep adding to the same preservation fund.

By keeping your retirement savings invested, you can harness the power of compound interest for the long-term growth of the nest egg that will provide income in your retirement. However, while preservation funds are designed to maintain and grow retirement savings, the fees associated with these funds can significantly impact their long-term value.

Understanding the fees you’re paying on your investment is essential when moving your savings into a preservation fund. High investment fees can quickly erode your savings – and advisory fees, management fees, and hidden costs can exacerbate the issue. Choosing a provider with low, transparent fees, on the other hand, allows more of your money to remain invested, increasing the potential for capital growth.

Did you know? A 1% reduction in fees can translate to as much as 30% more savings by the time you retire.

See your pension savings grow with our

Preservation Fund calculatorDirect investing is an effective way to eliminate advisory fees, which can otherwise eat away at your preservation fund returns. By removing these additional costs from the equation, you retain more of your investment growth, allowing your savings to compound more effectively over time. At 10X Investments, we offer low fees, typically 1% or less (depending on how much you have invested and the product you're invested in) as well as a suite of calculators, tools, and resources so that you can manage your preservation fund independently and with confidence.

Did you know? 10X Investments has highly experienced investment consultants ready to help you make the best decision for your financial future, free of charge. If you want to discuss your future, just get in touch.

Read on to learn more about how fees affect your investments and how 10X facilitates a smooth transition with our direct investment approach, so that you can keep more of your hard-earned money, retain control of your retirement savings and be your own financial hero.

Types of Fees in Preservation Funds and Their Effects

Fees play a crucial role in shaping the growth of your investment. When fees are low, they support long-term growth, but high fees can gradually eat away at returns, reducing the overall value of your savings. Over time, high fees compound, diminishing returns and eroding capital. In contrast, lower fees allow more of your returns to be reinvested, letting the power of compounding work in your favour.

You’ll also want to factor in inflation. Inflation erodes purchasing power over time, meaning that the money you have now will buy fewer goods and services in the future. In the context of preservation funds, high fees can exacerbate the impact of inflation by further reducing the real returns on your investment.

To maintain and grow the real value of your savings, it's essential to combine low fees with investment strategies that aim to outpace inflation. In essence, minimising fees – along with diversified asset allocation to counteract inflation and provide stability in the face of market volatility – can prolong the life of your preserved savings, setting you up for a financially sound retirement. We’ll touch on strategic asset allocation further down, but for now, let’s dive deeper into fees.

Fund Performance VS Net Investment Returns

It’s important to distinguish between fund performance and net investment returns. Fund performance reflects the total returns generated by the underlying investment fund, which can vary based on market trends and the effectiveness of the fund’s strategy. The fees associated with managing your investment – such as management, performance and/or administration fees – do not directly influence fund performance, but do reduce the returns you receive. What remains after deducting fees is known as your net investment return. Then, you also have to factor in the impact of inflation on the real value (i.e. purchasing power) of that return.

For example, if you invest R100,000 in a fund with an 8% annual return, you’d expect to earn R8,000. However, if your provider charges a 1% fee (R1,000), your net return would be R7,000. It’s this net return that truly matters. Now, factor in inflation: if inflation averages 3% per year, the real value of your net return would be R4,000.

If fees were higher – say 3% (R3,000) – your net return would drop to R5,000, and after accounting for inflation, the purchasing power of your return would shrink to just R2,000. This demonstrates the critical role low fees play in preserving the value of your returns and promoting the long-term growth of your retirement savings. Furthermore, as your investment grows, those higher fees compound against you. Consider the below graph for a striking representation of the long term effects of high fees.

Management Fees And Hidden Costs

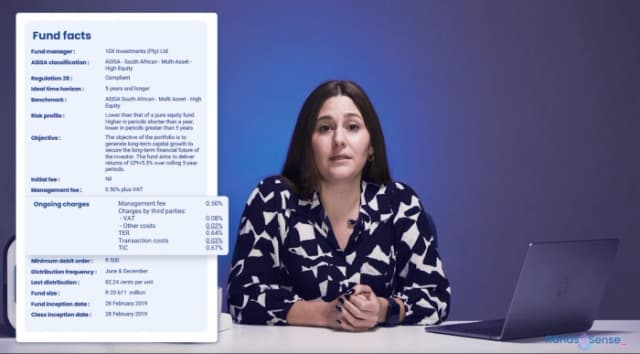

It’s equally important to understand the different types of fees charged by providers in order to make an informed decision about where best to invest your money. Some fees, such as management fees, cover portfolio oversight, while performance fees depend on the fund’s results. There may also be hidden charges like transaction and administrative costs, which can quickly accumulate and impact your savings. To maximise growth, it’s essential to choose a provider that minimises fees and offers full transparency.

At 10X Investments, we focus on simplicity and cost-effectiveness with a single management fee, which decreases as your investment grows. There are no upfront, advice, or exit fees, and you won’t encounter penalties if you adjust your investment strategy. By avoiding common fees, we make sure that more of your money stays invested and continues to benefit from compounding growth so that you achieve better outcomes in the long run.

If you’re unsure of the fees you’re paying, ask your broker or provider for your Effective Annual Cost (EAC), and then use our EAC calculator to see if your investments could be doing better. It could be the most important thing you do for your future self.

Ditch Advisory Fees For Direct Investing

It’s also important to consider advisory fees. As mentioned, you could go the route of relying on a financial advisor to help you make a decision regarding your preservation fund, but these fees – typically charged as a percentage of your investment – can accumulate over time and significantly reduce your net returns. However, with the right knowledge, resources, and accessible tools, you can take charge of managing your preservation fund independently.

Every basis point in fees saved is effectively an increase in your investment returns, and without advisory fees eroding your profits, more of your money stays invested, allowing for greater compound growth over the long term. Direct investing also grants you full control over your investment decisions, so that you can align your portfolio with your own personal financial goals and risk tolerance. Taking control of your portfolio can be both rewarding and cost-effective, which is why 10X provides a handy preservation fund calculator, portfolio management resources, and experienced investment consultants on call and free of charge to facilitate your retirement savings plan.

9 out of 10 people do better with 10X

The Two-Pot Retirement Savings System and Your Preservation Fund

The two-pot retirement system implemented from September 1st splits your preservation fund into two pots (and a separate vested component if you were invested before September 1st). The savings component is there for unexpected emergencies, whereas the retirement component is intended to remain untouchable until retirement. While you can withdraw from your savings pot once per tax year, it’s important to consider the conditions that will apply.

Unlike the previous system, which allowed only one withdrawal before retirement, you can now access your savings pot annually, if necessary. However, you are expected to withdraw at least R2,000 from the savings pot when making a withdrawal. The administration fee will be R300 (excl. VAT) and will be deducted before applying for tax. Withdrawals from the savings pot are also taxed at your marginal tax rate and SARS will deduct any other money you might owe them before you receive anything.

Keep in mind, while the new system offers more flexibility and the option to withdraw a lump sum annually, it's still wise to preserve as much of your savings as possible in preparation for your retirement.

Index-Tracking VS Active Fund Management

In the context of preservation funds, index-tracking funds offer significant cost-saving advantages. Index funds are designed to mirror the performance of a benchmark index, providing returns that closely match the index. On the other hand, active funds depend on the fund manager's skill at investing in whatever assets they feel will achieve returns that exceed the benchmark. Unlike index funds, which aim for consistency, active funds seek to outperform but often at the cost of greater volatility in their performance.

One of the primary benefits of index-tracking is its cost-effectiveness. Index-tracking funds typically require less frequent trading and less research, leading to lower investment management overheads and therefore lower fees. On the other hand, actively managed funds incur higher operational costs due to ongoing research, analysis, and active trading. These additional expenses are often passed on to investors through higher fees, which can substantially reduce the net returns of a fund investment over time.

The S&P Indices Versus Active (SPIVA) Scorecards show that a significant majority of active funds consistently fail to outperform their benchmarks over the long term. SPIVA scorecards use net-of-fees returns for actively managed funds. They ignore any fees (such as costs associated with dealing with client redemptions) that do not directly relate to what a manager charges for their purported skill. This means the SPIVA scorecards tell us the proportion of active managers that were unable to beat their benchmark (through bad luck or due to the absence of skill) after deducting the cost paid by an investor for that manager’s purported skill.

For preservation fund investors looking to bolster their retirement savings via low fees and consistent returns, opting for index-tracking funds over active fund management can be a good choice – one that can grow retirement savings more consistently and effectively.

More About Your EAC

The Effective Annual Cost (EAC) is a standardised metric established by ASISA to help investors evaluate the overall cost of owning and accessing an investment. It reflects the total annual expenses associated with an investment product, including fees for investment management, administration, advice, early exit penalties, loyalty bonuses, and guarantees. By reviewing your EAC with your current provider or potential alternative providers, you can assess the true cost of maintaining an investment and identify which provider offers better value.

Comparing EAC percentages across providers allows you to gauge the cost impact on your preservation fund investment. A lower EAC generally indicates that a greater portion of your investment is generating returns for you, while higher EACs can erode net returns as fees accumulate over time. Since lower costs can have a meaningful effect on long-term investment growth, it’s – once again – essential to choose a provider with transparent, competitive, and fair fees.

Inflation And Fees: Maintaining Purchasing Power With Strategic Asset Allocation

Now that you know a little more about the negative effect high fees can have on your retirement savings, the next question is whether your money is invested in the assets most likely to give you the investment outcomes you’re aiming for. As mentioned earlier, the impact of high fees on your preservation fund investment can be worsened by inflation. To make sure your preserved savings maintain and grow their value, it's important to adopt a strategy that combines low fees with an investment portfolio designed to outpace inflation. By keeping fees to a minimum and diversifying your assets to guard against inflation, you can extend the longevity of your retirement savings and secure a more stable financial future.

10X Investments offers various underlying funds with different asset allocations to cater to different risk appetites and investment horizons. Essentially, by selecting the right fund for your investment goals, you have the freedom to customise your underlying investment portfolio by diversifying across various asset classes such as equities, property, bonds, and even offshore investments (limited to 45% in preservation funds according to Regulation 28 of the Pension Funds Act). Diversified asset allocation strategies – like 10X employs in our underlying funds – spread investments across different asset classes and geographical regions to reduce risk while looking to outpace inflation by a healthy margin.

Diversification across multiple asset classes allows you to benefit from different economic cycles, enhancing the performance of your portfolio. Equities, for instance, have historically outpaced inflation by an average of around 7% annually, offering a solid buffer against rising prices. During periods of market turbulence, a well-balanced portfolio with some exposure to conservative assets like bonds or cash can provide stability. Offshore investments further mitigate risks tied to the South African economy, offering a safeguard against a potential depreciation of the Rand and local economy.

Limits On Offshore Investing: Investing offshore provides access to a wider range of global investment opportunities and helps diversify against country-specific risks. Regulation 28 of the Pension Funds Act limits the offshore investment exposure of preservation funds to 45%.

Each asset class carries its own level of risk, and for this reason, it's usually not advisable to focus purely on high-growth, high-risk assets, nor to aim for an entirely risk-free approach. Essentially, as the old adage goes, try not to put all your eggs in one basket. Regularly reviewing and adjusting your asset allocation to match your changing risk tolerance as you approach retirement can help you manage market risks, stay ahead of inflation, and set you up for a comfortable transition into your golden years.

10X provides a range of diversified underlying funds, each designed to align with regulatory restrictions and cater to various investment goals and risk tolerances. These funds feature different asset mixes, including varying levels of offshore allocations, allowing you to choose an option that best aligns with your retirement goals and personal risk tolerance.

For example, the 10X Your Future Fund provides diversified exposure to a range of asset classes, including stocks, bonds, and property – both locally and internationally. This fund is tailored for investors seeking long-term capital growth with a balanced approach to risk. Suitable for a variety of investor profiles, it aims to deliver returns that outpace inflation while managing volatility through diversification. This flagship fund is a great choice for those looking to secure their financial future with a well-rounded investment strategy.

Build a Strong Preservation Fund with Low Fees and Diversified Investments

Securing long-term growth in your preservation fund calls for a careful consideration of fees and a diversified asset allocation strategy, and resisting impulsive reactions to short-term market fluctuations.Taking charge of your portfolio can be both cost-efficient and rewarding. To support this, 10X offers a range of tools and resources, and access to experienced investment consultants at no cost to you.

Related articles

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.