Preservation Fund FAQs

Preservation Funds are one of the best solutions for allowing your pension, provident or retirement fund to continue to grow right through to retirement. Most South Africans have multiple different jobs throughout their lives, which presents the need to move the lump sum of their retirement savings held in a pension or provident fund from their existing employer to their new one, or to select another provider to invest those funds with via a preservation fund. Rather than withdrawing this money and halting the compound growth of their savings, preserving allows savings to be further nurtured until the point of withdrawal at retirement age (the legislated minimum age for which is 55). We hope this question and answer document empowers you to make the right decisions about your pension funds.

Contents

10X Investment Preservation Fund Solutions

There are numerous benefits to utilising a preservation investment service for long-term retirement planning and, at 10X Investments, we set ourselves apart as a leading option for managing your retirement savings by prioritising transparency, long-term strategic asset allocation, diverse investment portfolios, and consistently low fees – and we pride ourselves on offering an expert personal touch, as well. We hope this question-and-answer document will provide more insights into preservation investment offerings, how these funds work, and why they are the best choice for individuals wanting to safeguard their retirement savings during a period of employment transition.

See your pension savings grow with our

Preservation Fund calculatorWhat Are Preservation Funds?

A preservation fund is a financial product that safeguards accumulated retirement savings – so named because they allow you to preserve the value of your provident/pension contributions at the point at which you need to withdraw them from the fund. They are typically used by people transitioning to a new job, who need to move their pension or provident funds away from their previous employer’s pension scheme as a result.

What Are The Benefits Of A Preservation Fund?

Preserving offers a host of important benefits for investors, serving as a tax-efficient method to safeguard their retirement savings during job transitions. They ensure the continuation of compound savings growth, provide investment flexibility, and allow investors to maintain their financial security while approaching their retirement goals.

Preservation Fund Calculator

This is a simple financial tool designed by 10X Investments to help future investors estimate the projected value of their preserved savings over time. By inputting your age and the amount of money you wish to preserve into our preservation fund calculator, you are able to receive an estimate of how much you stand to grow your savings with 10X Investments, as well as a comparison between your savings potential with 10X compared to options that have higher fees and market-level performance.

Can You Withdraw Money From A Preservation Fund?

Under the two-pot retirement system, withdrawal rules for preservation funds have changed. Here's what you need to know:

Two-pot system: Your preservation fund will be divided into two components – a "savings pot" and a "retirement pot".

Savings pot withdrawals: You can make one withdrawal per tax year from your savings pot, subject to certain conditions.

Retirement pot: This portion remains preserved until retirement, except in specific circumstances like permanent disability.

Annual withdrawals: Unlike the previous system where only one withdrawal was allowed before retirement, you can now access funds from your savings pot annually if needed.

Minimum withdrawal: There's a minimum withdrawal amount of R2,000 from the savings pot.

Tax implications: Withdrawals from the savings pot will be taxed at your marginal tax rate.

Remember, while the new system provides more flexibility, it's still advisable to preserve your savings for retirement whenever possible.

Preservation Fund Withdrawal

While it is hugely beneficial to your savings and retirement outlook to not touch your preserved money before retirement, there may be financial reasons that leave you in need of withdrawing from your preserved savings early. However, before withdrawing early from your retirement fund, it’s important to weigh up a few factors and alternate investment options.

Under the new two-pot system, consider these factors before withdrawing from preservation funds:

Purpose: The savings component is intended for unexpected emergencies such as family emergencies, medical emergencies, urgent home repairs, legal issues and natural disasters.

Tax implications: Withdrawals from the savings component are taxed at your marginal rate.

Frequency: You can only make one withdrawal per tax year from the savings component.

Minimum amount: You must maintain a minimum balance of R2,000 in the savings component.

Impact on retirement: Any withdrawal reduces your retirement savings.

Accessibility: There may be circumstances where you cannot withdraw, such as if you have a pension-backed home loan, owe your employer damages, have a pending divorce order, or owe maintenance.

Always consult with a financial expert to understand the full implications of withdrawing from your retirement savings.

How Much Can I Withdraw From My Preservation Fund?

Under the new two-pot system, effective from 1 September 2024, the amount than can be withdrawn from preservation funds is determined by the following:

Savings component: You can withdraw once per tax year, provided there's a minimum balance of R2,000. There's no maximum limit on the withdrawal amount.

Retirement component: This remains inaccessible until retirement.

Vested component: Existing savings as of 1 September 2024 (minus the amount transferred to the savings component) retain previous withdrawal rules.

Remember, all withdrawals from the savings component are taxed at your marginal rate. Consider the long-term impact on your retirement savings before making any withdrawals.

How Many Times Can I Withdraw From A Preservation Fund?

The two-pot system, effective from 1 September 2024, changes withdrawal rules of preservation funds:

Savings component: You can make one withdrawal per tax year (March 1 to February 28/29), provided there's a minimum balance of R2,000.

Retirement component: This remains inaccessible until retirement, or at the age of 55.

Vested component: Existing savings retain previous withdrawal rules.

Remember, while the system allows for more frequent access to the preserved savings component, it's designed for emergencies, not regular income. Carefully consider each withdrawal's impact on your long-term retirement savings.

Can I Borrow Money From My Preservation Fund?

Generally, you are only able to borrow money from your preserved savings if that is permitted by the rules stipulated by your fund, in the case of very specific purposes (such as paying off a property). 10X offers comprehensive support to members to aid in answering questions such as these. Simply get in touch with one of our consultants and we’d be happy to discuss your current situation.

Preservation Fund Rules

There are several regulations that apply in a 10X Investments fund for your preserved savings. These rules impact when you can access your preserved savings, as outlined earlier, and how much you can withdraw from your preserved savings both before and after your retirement. The two-pot retirement system, effective from 1 September 2024, introduces these key rules:

Three-component structure: Your fund will have a vested component (existing savings), a savings component, and a retirement component.

For the savings component, you are allowed one withdrawal per tax year, subject to a minimum balance of R2,000. There is no maximum withdrawal limit. Withdrawals are taxed at your marginal income tax rate. Withdrawals from the savings component are intended for emergencies, not lifestyle enhancements, or for those who have perhaps fallen on hard times and need the money.

The Retirement component remains preserved until retirement.

The Vested component retains the pre-2025 withdrawal rules (see below).

These new rules aim to balance preservation for retirement with limited pre-retirement access. Always consult with a financial expert to understand how these changes affect your specific situation.

Pre-2025 rules: Most importantly, when you choose to retire – and provided your vested component exceeds R247 500 – you are obligated to use at least two-thirds of your preserved savings to purchase either a living or a life (guaranteed) annuity, with the final third being available to be withdrawn as a lump sum.

Your preservation retirement fund will also have minimum and maximum contribution limits, with 10X’s having a R50,000 transfer minimum contribution. While you can invest the proceeds you have saved from different pension or provident lump sums into either one or many separate preservation funds, you are not able to split the proceeds from one pension or provident sum across multiple preservation funds. Contributions cannot be made to your money once preserved from other sources; the growth of your preserved savings occurs only from its net investment return (i.e. the performance of the underlying investment funds minus fees).

Preserved savings are tax-effective in that your investments do not incur capital gains tax or income tax as long as they remain invested in a preservation fund. The tax incentives included in preservation savings encourage individuals to avoid cashing their retirement early and rather opt to preserve their savings and leverage the power of compounding to grow their retirement savings instead.

Another benefit, you do not incur taxes on the investment returns earned by your preserved savings. You are taxed at favourable rates when withdrawing from your preserved savings during retirement. These tax benefits become void should you cash in a lump sum from your pension savings early.

Why Is Preserving Beneficial For My Retirement?

Deciding to preserve your savings is highly beneficial for planning your retirement for several reasons, most notably the contribution towards long-term financial security and peace of mind when it matters most. 10X Investments brings even more stability to your savings goals by having no upfront fees, advice fees, or exit fees, no penalties for changing your investment model, and no hidden costs that might catch you off guard.

Aside from the unique perks that come with choosing 10X, opting to preserve your savings comes with the following benefits:

It comes with tax efficiency. As previously mentioned, putting your pension savings in a fund allows for considerable tax benefits that make them a favourable vehicle for retirement savings. The growth of investments within the fund is tax-free, thereby allowing your retirement savings to compound over time without any of it being lost to taxation.

Your money undergoes compound growth. As time passes towards your retirement, your pension and the investment returns on your preservation accumulate. Compound growth of your preserved savings can significantly increase the value of your retirement fund, so that by the time you retire, your investment is large enough to provide drawdowns that help you live comfortably through your retirement.

You are able to enjoy flexible terms with your investment model. At 10X Investments, our preservation funds come in a range of investment options depending on your risk tolerance, investment objectives, and timeline towards retirement. 10X also offers a progressive fee structure, meaning the more you invest, the less you pay in fees.

Your savings remain portable. For individuals changing jobs, preservation funds allow you to maintain your hard-earned savings contributions to your pension fund even while changing employers. This ensures you are able to continue your retirement savings with the flexibility you need during a job transition. You are also able to move your preserved savings between different service providers once a year should you feel the need.

Preserving Is Best With 10X Investments

Retirement planning is a central component of securing your financial future after you leave the working stage of your life. Whether you’re transitioning between jobs, facing unemployment, or readying for retirement, informed planning is important. At 10X Investments, we understand that planning your retirement can be a complex process with many factors to consider. That’s why we make sure to support our members at every step of the journey with retirement-focused expertise and transparency into their options.

By gaining an understanding of the benefits of a preservation fund and implementing key retirement planning strategies, you have the potential to secure a prosperous retirement. At 10X, we strive to help you harness this understanding. To this end, we have comprehensive resources and blog posts on our website to inform your decision to preserve your savings. When you opt for a 10X Investment Fund, you aren’t required to use a broker – you are able to deal with 10X directly – and for prospective members, our highly-experienced consultants are available to equip you with the important information you need to make an educated choice for your retirement savings.

Preserving your retirement savings in a 10X preservation fund enables you to maintain the compound growth of your investments while avoiding unnecessary tax implications until the point of withdrawal at retirement. Withdrawals from retirement savings accounts are often penalised or heavily taxed – by preserving these funds and avoiding withdrawals until they are absolutely necessary, you are effectively steering clear of tax implications. This comes with the added benefit of allowing your investment to compound efficiently.

Additionally, preserving stands to protect individuals from losing their unclaimed benefits or savings when moving jobs, by simplifying financial planning and centralising retirement assets. Essentially, when you decide on a preservation fund, you are protecting unclaimed benefits that may have come from previous employers or income sources. By centralising these savings and retirement assets, it becomes substantially easier to keep track of your finances and avoid forgetting about retirement savings that may have come from previous employment. With the 10X Preservation Fund offerings, transparency and thorough communication are consistently maintained to ensure that members receive all the money that is rightfully theirs.

Setting up a preservation fund also helps you to avoid the tempting opportunity to withdraw early and miss out on the considerable benefits that come from leaving your preserved savings untouched. It’s important to remember that the benefit of a preservation fund is not only that those savings are protected from early withdrawal by yourself and from creditors in terms of section 37B of the Pension Funds Act. It's also about allowing those savings to compound over time. By preserving your retirement savings you can maximise the compound growth of your capital, which involves reinvesting your returns to generate greater interest income in future. When you decide to preserve your savings, you can ensure that this process goes ahead unhindered – providing substantial long-term benefits.

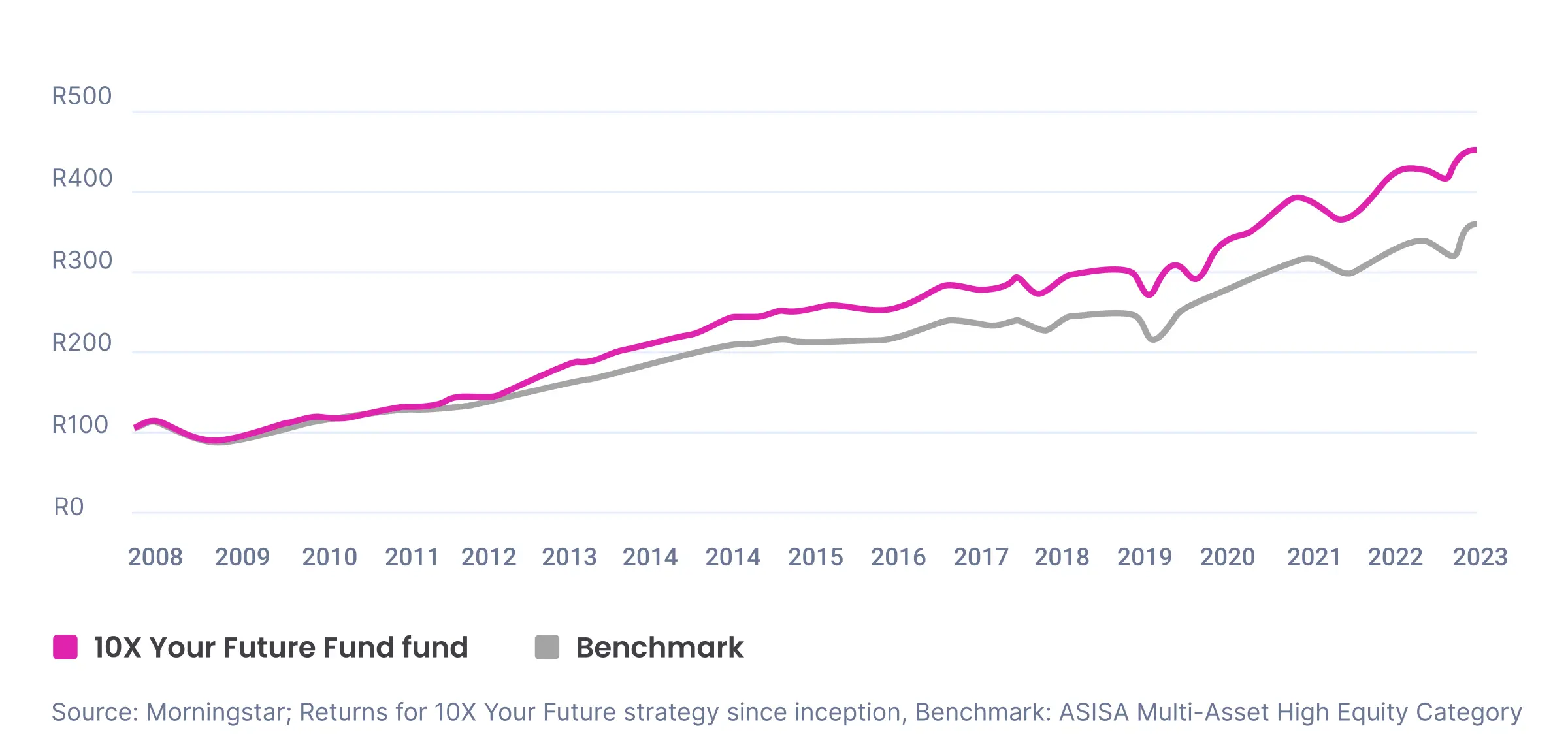

Compound growth should ideally form an intrinsic part of your pension investment strategy and, at 10X Investments, we ensure a long-term strategic asset allocation approach that is designed to maximally leverage compound growth by consistently outperforming the market, as the 10X Your Future Fund has done every year since inception.

We also believe that being well-diversified is the best way to manage risk and to deliver better long-term returns on your retirement savings. Our investment strategy is robust and has a proven record of success, simply take a look at this investment report – this is the reason why we deliver consistently market-beating long-term returns. By opting to join 10X and benefiting from our range of preservation fund offerings, you are taking a significant step towards achieving a comfortable, sustainable retirement lifestyle. For the average working South African, the decision to preserve can make a huge difference in the later stages of their life.

Preservation Fund Contact Details

Curious to learn more about how to set yourself in good standing for your retirement? At 10X, we aim to make it easy for you to find the answers to your questions, by making the important information, legislation, and investment terms easily accessible. To learn more, simply visit our contact page and tell us a bit about yourself. A retirement expert will get back to you right away.

10X Investments is an authorised Financial Services Provider (FSP number 28250). The content herein is provided as general information and is not intended as nor does it constitute tax, legal, investment, or financial advice as defined by the Financial Advisory and Intermediary Services Act, 2002.

The 10X Living Annuity is underwritten by Guardrisk Life Ltd.

How can we 10X Your Future?

Begin your journey to a secure future with 10X Investments. Explore our range of retirement products designed to help you grow your wealth and achieve financial success.